Entering Real Estate Investing Without Cash or Credit

Starting your real estate journey with no cash or credit can seem daunting, yet alternative methods pave the way. By leveraging wholesaling, seller financing, lease options, and partnerships, you can control properties and generate income with minimal personal capital. In this article, discover practical methods to gain and monetize real estate access with no cash or credit.

To learn more about investing without cash or credit, visit: real estate investment tools

Innovative No-Money-Down Techniques

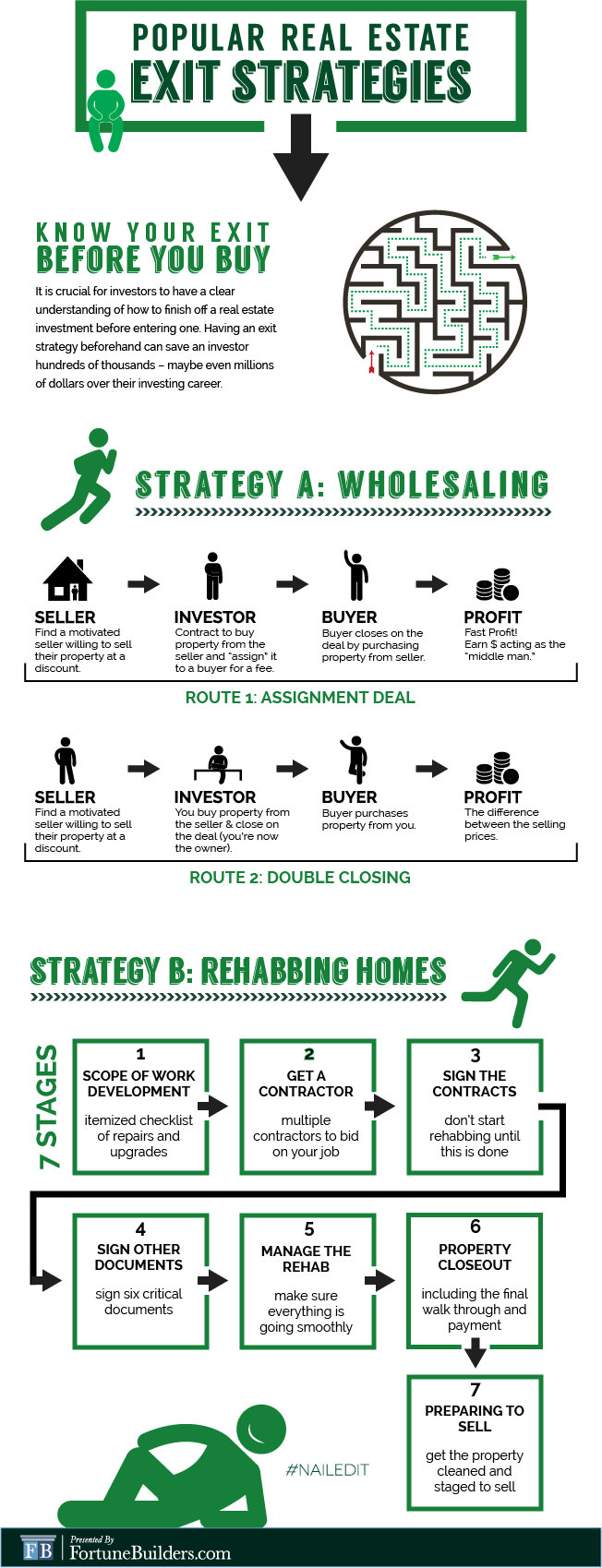

Wholesaling lets you lock in discounted purchase contracts and flip them to end buyers without funding the purchase yourself. This method bypasses the need for large down payments or bank approvals while still providing a steady deal flow. Thriving in wholesaling requires pinpointing distressed properties, calculating ARVs, and cultivating a reliable investor network.

Creative Owner-Financing and Lease-Purchase Methods

Seller financing involves structuring a deal where the property owner carries the loan, letting you pay them directly over time. Lease options let you rent a property with the right to purchase at a preset price, giving time to improve credit or secure funding. Both techniques let you control real estate today and buy later, often requiring little to no initial cash.

Joint Ventures & Partnerships

By teaming up, you leverage a partner’s cash and credit while offering your negotiation and sourcing expertise. Profit-share agreements divide returns based on each party’s contribution, aligning interests and minimizing personal risk. A well-drafted joint venture agreement with transparent objectives secures smooth collaboration.

Tools & Resources for No-Cash Investing

Integrating lead management systems with property calculators helps you prioritize the best opportunities. Digital hubs for real estate investing often feature exclusive no-money-down deal listings. Expert blogs and courses offer tutorials, case studies, and market insights tailored to no-cash investors.

Best Practices for No-Money-Down Deals

Always conduct thorough due diligence—verify title status, liens, and property condition before contracting. Maintaining a ready network of investors accelerates deal flow and reduces carry time. Effective negotiation and honest value articulation secure profitable deals.

For more information on investing without cash or credit, visit: best software for real estate investors

Conclusion & Next Steps

While unconventional, no-money-down techniques can yield substantial returns when executed properly. Combining contract flipping, owner carry, rent-to-own, and partnerships empowers you to expand your portfolio without large down payments. Start by educating yourself, forming solid legal agreements, and cultivating a network of buyers and partners. Through consistent effort, ethical practice, and adaptive learning, you can turn zero-down deals into lasting success.